Car Loan Interest Rates Today

When you finance a car you borrow the amount of money you need to buy the car and the lender charges you interest.

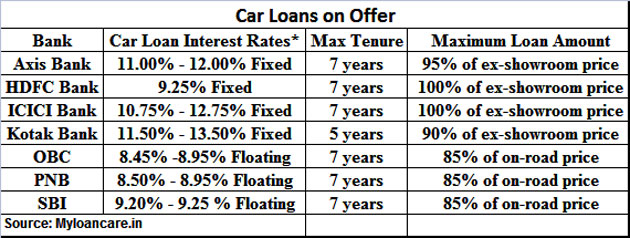

Car loan interest rates today. The rate of interest you get on your car loan would depend on various factors like the amount of loan you are seeking value and make of the car your monthly income your pre existing loans your expenses your relationship with the bank and credit history. Find all banks latest car loan interest rates. Compare best car loan interest rates in india for 2020. Average auto loan rates by credit score.

Even if your credit score is lower you may still qualify for. Compare auto loan rates. Credit scores of 719 for a new car or 655 for a used car or higher will help you qualify for the lowest auto loan interest rates. You can take the loan for 90 to 100 of the on road price of the car.

But you ve got the knowledgeable wallethub community. After rates set by the federal reserve your credit score has the most impact on the car loan interest rate you ll pay. And repayment tenure of up to 8 years you can find the most suitable vehicle loan for your needs at bankbazaar. Bank of baroda has one of the most competitive rates of interest on car loans.

See rates for new and used car loans and find auto loan refinance rates from lenders. Car loan with interest rates as low as 7 35 p a. The following example shows the amount of interest you could end up paying for a brand new 36 000 car assuming a loan term of 7 years and a down payment of. As a result before agreeing to car loan financing make sure you can afford it even if the current auto loan interest rates rise.

In addition car loan interest rates may be fixed or variable and might come with low introductory offers. If you have a good credit score you ll qualify for a lower interest rate. Car loan interest rates today you can utilize our auto loan calculator to see which alternative produces the ideal outcome for your needs. Cars and truck loans in singapore commonly bill level rates of interest suggesting rate of interest payment is a consistent amount every month over the life of a loan.