Best Retirement Plan Malaysia

Prs is a voluntary long term investment and saving scheme designed to help you save adequately for retirement.

Best retirement plan malaysia. 3 best retirement plans in singapore in terms of coverage guaranteed returns and flexibility. In short if you want the best retirement lifestyle and sustainability you will love this guide. The core inflation rate is typically. No less than 12 factors are taken into account when assessing potential destinations such as cost of living political life retirement benefits malaysia climate and healthcare all based on a couple of retirees living with at least 1 500 per month.

The retirement goal calculator does not analyse your financial position investment objectives or individual needs in coming up with the results. Cpf life makes a good retirement plan in the sense that you get a fixed amount of pay out each month following retirement. This means a monthly retirement income of the only rm950 per month assuming a life expectancy of 75 years old. How many years of income do you require during retirement.

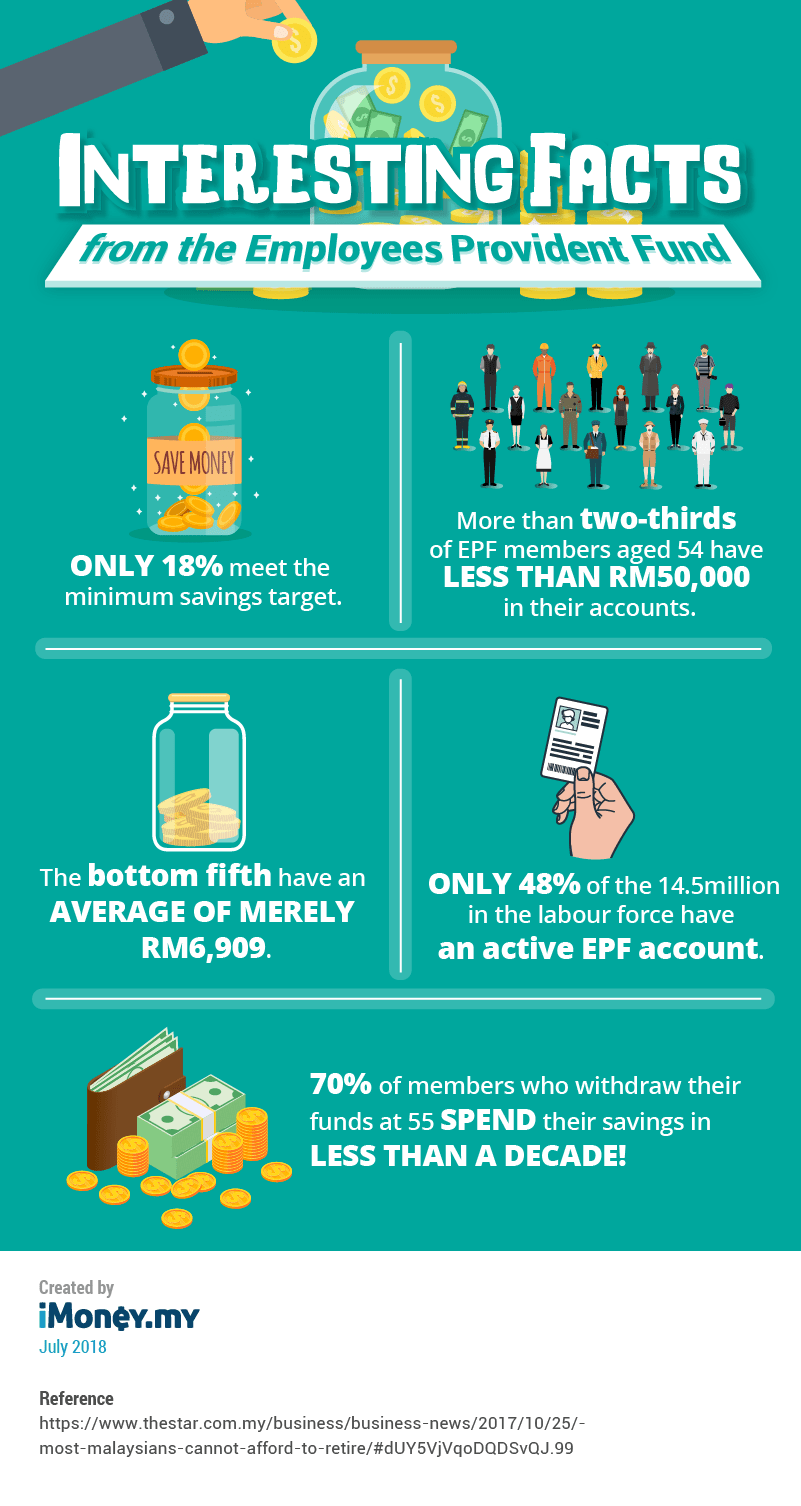

Average life expectancy for a male is 72 and 77 for a female. The 7 best retirement plans options to consider. Pensions having a pension is the first thing most people think of they think of retirement income. Last year the employees provident fund epf raised the minimum savings target to rm228 000 by the age of 55.

Based on data from the malaysia department of statistics. According to a study by the asian strategy leadership institute most households in malaysia have zero savings. Miscalculations in terms of your retirement fund can be caused by common misconceptions such as these. Prudential assurance malaysia berhad is an indirect subsidiary of prudential plc.

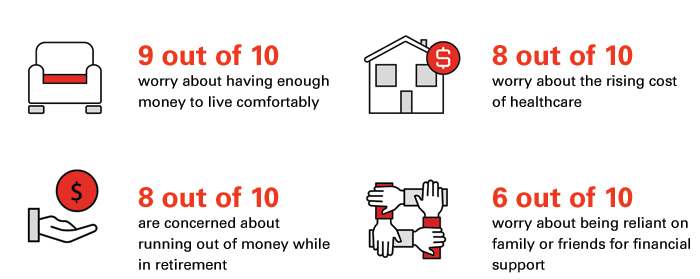

So is your retirement fund sufficient. If you want to be independent and able to afford the best things in life you need a retirement plan. Many people have earned a pension at some point during their working careers. In essence people are worried about retirement.

Neither prudential assurance malaysia berhad nor prudential plc is affiliated in any manner with prudential financial inc a company whose principal place of business is in the united states of america or with prudential assurance company a subsidiary of m g plc a company incorporated in the united kingdom. With all the talk revolving around the epf withdrawal age lately the topic of the best retirement plan in malaysia seems to be on the tip of everybody s tongue. You shall not rely on the retirement goal calculator or on product recommendations by ocbc bank officers to make any investment or financial decisions. Almost 90 of working malaysians earn less than rm5 000 a month and only half of them are active contributors to the employees.

It requires very little involvement because the employer contributes the money on behalf of the employee. Prs is made available to all malaysians who are employed and self employed.