2017 Tax Rate Malaysia

No guide to income tax will be complete without a list of tax reliefs.

2017 tax rate malaysia. As featured in channel newsasia. Malaysia corporate income tax rate for a company whether resident or not is assessable on income accrued in or derived from malaysia. Melayu malay 简体中文 chinese simplified malaysia personal income tax rate. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g.

7 sept 2020 forum. Malaysia brands top player 2016 2017. There are no other local state or provincial. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia.

Income tax rate malaysia 2018 vs 2017. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. Green technology educational services. What is tax rebate.

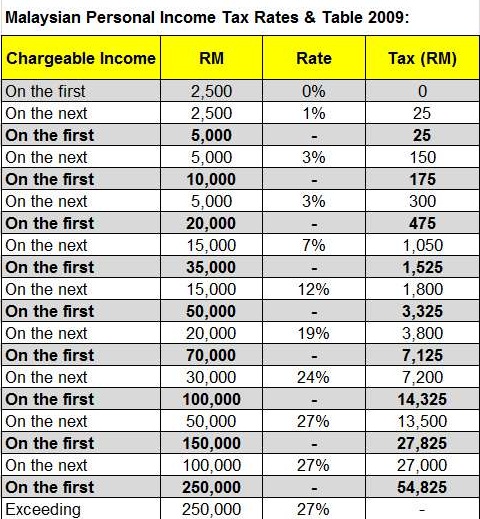

Not only are the rates 2 lower for those who has a chargeable income between rm20 000 and rm70 000 the maximum tax rate for each income tier is also lower. Technical or management service fees are only liable to tax if the services are rendered in malaysia while the 28 tax rate for non residents is a 3 increase from the previous year s 25. This page is also available in. Malaysia income tax e filing guide.

Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. Kalender pajak bulan september 2020. A firm registered with the malaysian institute of accountants. For assessment year 2018 the irb has made some significant changes in the tax rates for the lower income groups.

With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. Pwc 2016 2017 malaysian tax booklet personal income tax tax residence status of individuals an individual is regarded as tax resident if he meets any of the following conditions i e. How does monthly tax deduction mtd pcb work in malaysia.

Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Penerapan single identity number sin guna menarik pajak orang ber ktp. In malaysia for at least 182 days in a calendar year.

Cara konfirmasi surat keterangan wajib pajak umkm oleh pemotong pemungut pajak. Some items in bold for the above table deserve special mention. Rupiah menguat begini kurs pajak tanggal 2 8 september 2020. No other taxes are imposed on income from petroleum operations.

What is income tax return.